Decoding Essential Auto Insurance Coverage Types

When you review auto insurance basics, it’s important to know exactly what each part of your policy does. Coverages range from paying for someone else’s losses to protecting your own vehicle in non-collision events. This section explains the main coverage types so you can choose essential protections and optional extras that suit your situation.

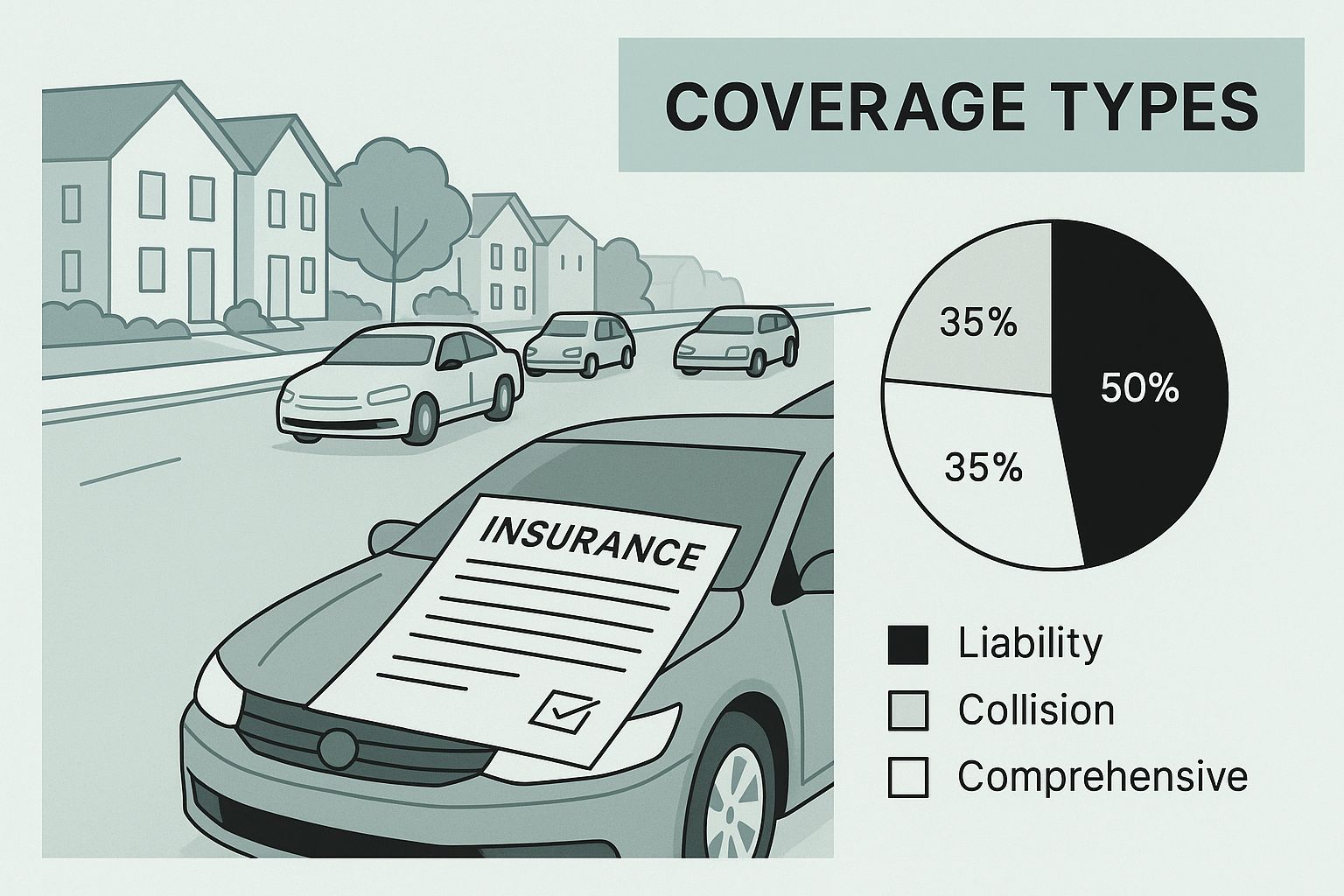

Understanding Liability Coverage

Liability coverage forms the base of most state-required policies. Bodily Injury Liability covers medical expenses and lost wages if you injure someone in an at-fault accident. Property Damage Liability pays for repairs when you damage another person’s car or property. Without adequate liability limits, you could face out-of-pocket costs and potential legal fees.

Core Coverage Comparison

| Coverage Type | What It Covers | Typical Deductible | State Requirement? |

|---|---|---|---|

| Liability | Third-party injuries and property damage | N/A | Yes |

| Collision | Repairs after impact with another object | $250–$1,000 | No |

| Comprehensive | Losses from theft, weather, or animals | $250–$1,000 | No |

| Uninsured/Underinsured Motorist | Injuries and damage when other driver lacks sufficient coverage | N/A | Varies by state |

Exploring Collision And Comprehensive

Collision insurance pays when your vehicle strikes another car or object, such as a guardrail or mailbox. Comprehensive insurance covers non-collision events like vandalism, hail, or theft. Opting for a higher deductible can lower your premium but requires you to have more set aside for emergencies.

Global motor insurance premiums reached $922.5 billion in 2023, reflecting growing demand as vehicle ownership rises worldwide. Read the full research here

Uninsured And Underinsured Motorist Protections

Even if you carry solid coverage, others on the road may not. Uninsured Motorist (UM) protection covers your medical bills and vehicle damage when the at-fault driver has no insurance. Underinsured Motorist (UIM) steps in if their limits are too low to cover your expenses.

Key tips:

- Verify your state’s UM/UIM requirements.

- Evaluate your commute (urban areas often see higher hit-and-run rates).

- Match UM/UIM limits to your liability coverage for consistent protection.

Learn more in our guide on Demystifying Auto Insurance: Everything You Need to Know.

Building Your Ideal Policy Mix

Craft a policy by balancing state minimums with the extra coverages you can’t afford to skip. Start by assessing your assets, risk tolerance, and budget. Then layer liability, collision, comprehensive, and UM/UIM to close any gaps. With these auto insurance basics, you’ll have the confidence that you’re covered when it matters most.

The Hidden Math Behind Your Premium Calculations

The data chart below shows percentage weights for the main risk factors used in premium calculations.

This visualization makes it clear that driving history (30%) and location (25%) carry the greatest influence on your final rate.

When you explore auto insurance basics, you’ll find a formula that assigns dozens of variables specific weights. Understanding how each piece fits can explain why two drivers with similar profiles often receive very different quotes.

Key Risk Factors And Their Weight

Insurers focus primarily on these elements:

- Driving History (30%): Accidents and violations push premiums higher.

- Location (25%): High-claim areas lead to steeper rates.

- Vehicle Type (20%): Expensive or performance cars add to risk.

- Age And Gender (15%): Younger drivers generally pay more until experience accrues.

- Credit Score (10%): Strong credit can trim your bill slightly.

Factors Affecting Auto Insurance Premiums

The following table outlines the primary factors insurance companies consider when calculating premiums and their relative impact on your rates.

| Factor | Impact Level | Can You Control It? | Potential Savings |

|---|---|---|---|

| Driving History | High (30%) | Yes | Up to 20% |

| Location | High (25%) | Partially | 5–10% |

| Vehicle Type | Medium (20%) | Yes | 10% |

| Age And Gender | Medium (15%) | No | N/A |

| Credit Score | Low (10%) | Yes | 5% |

By focusing on controllable areas like your driving record and vehicle choice, you can aim for the biggest reductions in rates.

How Insurers’ Algorithms Work

Behind the scenes, carriers feed your profile into predictive models trained on millions of claims. This algorithmic scoring places drivers on a continuous risk curve, meaning even a single speeding ticket can nudge you into a higher bracket.

Strategies To Lower Your Risk Category

You can take action on several fronts:

- Bundle Policies: Combining auto and homeowners insurance can save 5–15%.

- Maintain A Clean Record: Avoid minor violations to keep your risk score low.

- Review Coverage Annually: Adjust your limits based on changes in commute or vehicle use.

Moreover, the global motor vehicle insurance market grew by 22% between 2017 and 2023 and is projected to expand another 12% by 2028. Discover more insights about market growth here. Staying proactive today helps you lock in savings before broader rate adjustments take effect.

Mastering Deductibles and Limits for Maximum Protection

Understanding how deductibles and coverage limits work helps you balance premium savings and financial security. Your deductible is the out-of-pocket amount you cover before insurance applies, while limits cap what the insurer pays per claim. Tweaking these figures by a few hundred dollars can shift your premium by 10–20%, so weighing immediate savings against possible future costs is essential.

Setting The Right Deductible

Begin by reviewing your emergency fund and driving habits. If you cover 15,000 miles a year on crowded streets, a lower deductible can keep you from dipping into savings after minor fender-benders. Conversely, occasional drivers with solid savings might opt for a higher deductible to reduce their monthly bill.

Key considerations:

- Emergency Fund Size: Keep at least three months of expenses set aside.

- Accident Frequency: Busy routes raise the odds of collisions.

- Premium Reduction: A $500 increase in deductible often reduces premiums by 15%.

Balancing Coverage Limits

After choosing a deductible, pick limits that protect your assets without inflating costs. Coverage below state minimums leaves you exposed in lawsuits, while overly high limits add unnecessary expense.

Coverage Comparison Table:

| Limit Option | Annual Premium Impact | Coverage Strength |

|---|---|---|

| 25/50/25 (State Minimum) | – | Low |

| 50/100/50 | +12% | Moderate |

| 100/300/100 | +20% | High |

A good starting point is $100,000/$300,000 for bodily injury and $50,000 for property damage, then adjust according to your net worth.

Expert Tips And Common Mistakes

Claims professionals note these common errors:

- Underestimating repair costs on newer vehicles

- Ignoring inflation in medical and repair bills

- Failing to review default limits over time

The auto insurance market saw a surge in demand after travel resumed post-COVID. Explore this topic further

By mastering your deductible and limits, you’ll apply the core of auto insurance basics to find the right balance between cost and coverage.

Navigating the Claims Process Like an Industry Pro

An accident can create confusion in the first moments. For instance, securing all critical details right away can keep your claim on track. Collecting accurate information on-site helps avoid the 25% of claims that stall due to missing data. In short, the time you invest at the scene often pays off later.

Gathering Critical Information at the Scene

First, ensure everyone is safe. Then gather these essentials:

- Driver and Vehicle Information: Names, insurers, policy numbers

- Photos and Videos: Wide shots, close-ups of damage, license plates

- Witness Details: Contact information and brief statements

- Police Report Reference: Officer’s name, badge number, report ID

Also record weather, lighting, and road conditions. Skipping these details can leave gaps that adjusters will want you to fill later.

Documenting Your Claim

Next, create a clear, step-by-step account:

- Date, time, and exact location of the incident

- A factual description of events, avoiding assumptions

- Receipts for towing, rental cars, or medical bills

- Repair estimates from at least two certified shops

This method resembles preparing a legal brief—each document supports your version of events. With this record in hand, you’re ready for the initial adjuster call.

Working With Claims Adjusters

When you talk to a claim adjuster, choose your words carefully:

- Distinguish “total loss” from “write-off”

- Request a detailed breakdown of repair costs

- Clarify who covers the deductible and when

Adjusters look to manage expenses, so polite persistence typically works better than confrontation.

Negotiation Tactics and Common Pitfalls

Settling a claim involves strategy. Keep these points in mind:

- Present documented damage and medical expenses

- Use comparable repair quotes to counter low offers

- Resist accepting the first settlement figure

Reasons Claims Get Denied vs. Proactive Steps

| Common Denial Reason | Proactive Step |

|---|---|

| Insufficient documentation | Submit photos, receipts, and police report |

| Delayed filing | Notify insurer within 24–48 hours |

| Policy exclusions | Review your policy before you file |

| Disputed liability | Gather witness statements immediately |

When to File (And When Not To)

Weigh your deductible against repair costs for minor damage. Sometimes paying out-of-pocket or using uninsured motorist coverage makes more sense. Understanding the call management process can also speed up your insurer conversations.

With these steps, you’ll move confidently from the accident scene to your final settlement. Next, we’ll look at comparing insurance quotes for long-term value.

The Art And Science Of Comparing Insurance Quotes

Navigating auto insurance basics takes more than scanning price tags. Many carriers use varied terminology for similar coverages, which can lead to unexpected expenses. Building a side-by-side framework ensures you align limits, deductibles and add-ons for an apples-to-apples review.

Identify Equivalent Coverage Parts

First, match each quote on core protections. Consider these elements:

- Liability Limits: Verify per-person and per-accident amounts (for example, 100/300/100).

- Collision & Comprehensive Deductibles: Standardize on $500 or $1,000.

- Uninsured/Underinsured Motorist: Align UM/UIM coverage with your liability limits.

- Optional Add-Ons: Compare rental reimbursement, roadside assistance and gap coverage.

Standardizing these items helps you avoid surprises when filing a claim.

Evaluate Insurer Stability And Reputation

A low rate only matters if claims are paid reliably. Assess each carrier’s:

- Financial Strength: Ratings of A- or higher from major agencies.

- Complaint Ratios: Look for insurers below the industry average.

- Claim Payout Speed: Aim for average settlement under 30 days.

- Customer Reviews: Seek overall satisfaction above 4 out of 5 stars.

For insights on how claim events affect service, review our call management process.

Auto Insurance Coverage Comparison Chart

A comparison of standard coverage types across different policy tiers to help understand what protection you’re getting at each level.

| Coverage Type | Basic Policy | Standard Policy | Premium Policy | Is It Required? |

|---|---|---|---|---|

| Liability (100/300/100) | ✔ | ✔ | ✔ | Yes |

| Collision (Deductible $500) | – | ✔ | ✔ | No |

| Comprehensive (Deductible $500) | – | ✔ | ✔ | No |

| Roadside Assistance | – | Optional | ✔ | No |

| Rental Car Reimbursement | – | Optional | ✔ | No |

This comparison chart shows how coverage builds across tiers, highlighting which protections are included or optional.

Leverage Discounts Strategically

Most insurers provide a range of discounts; some deliver larger savings:

- Multi-Policy Bundles: 10–20% off by combining auto and home.

- Safety Features: Up to 15% off with anti-lock brakes or airbags.

- Low Mileage: 5–10% discount if you drive fewer than 10,000 miles per year.

- Defensive Driving: 5% reduction after completing an approved course.

Explore more tips in How to master cost-saving strategies for car insurance.

Timing And Negotiation Tips

You can often find lower rates in late summer when claims slow down. Renewing six weeks before expiration may trigger loyalty offers. Keep your organized quotes in a simple spreadsheet and present competitive rates to your current provider. A clear script—“I’ve found a similar policy at X rate; can you match it?”—can unlock extra savings.

Combining systematic comparisons with the right timing and negotiation tactics helps you secure both optimal coverage and maximum savings.

Critical Insurance Mistakes That Could Cost You Everything

Even after comparing quotes and signing on the dotted line, a few oversights can leave you financially exposed. Depending on state minimums alone is like wearing a thin raincoat in a storm—you’ll still get soaked. Major repairs and medical expenses can erode your savings if you don’t spot coverage gaps before they strike.

Underestimating State Minimums

Relying on minimum coverage often backfires when accident costs exceed basic limits.

- In many states, liability requirements sit at 25/50/25 (in thousands), enough for minor fender-benders but insufficient for serious crashes.

- 45% of drivers with minimum policies face out-of-pocket costs exceeding $20,000 after a major collision.

- One accident could saddle you with medical bills, legal fees and property repairs.

Review your liability limits every year to keep pace with inflation and life changes.

Overlooking Policy Stacking Opportunities

Layering coverage across vehicles can boost your protection without a big premium jump. Unfortunately, many policyholders:

- Treat each car’s policy as separate.

- Miss out on stacking uninsured motorist limits that can double or triple payouts after hit-and-runs.

- Overlook household umbrella options that raise total coverage by up to 30%.

Without stacking, a single underinsured driver could wipe out one car’s limits while damaging several others.

Ignoring Life Changes That Require Updates

Your policy should evolve when major events occur. For instance:

- Adding a teen driver can raise premiums by up to 50%—and failing to list them risks a denied claim.

- Moving to a ZIP code with higher claim rates may increase your rates by 15–25%.

- New safety features on your vehicle often earn discounts—if you report them.

Leaving these changes unreported often leads to canceled coverage, denied claims or surprise rate hikes.

Overlooking Exclusions And Fine Print

Every policy has exclusions that can catch you off guard like a hidden pothole:

- Wear-and-tear exclusions often leave brake and tire repairs on you.

- Electronic failures aren’t always covered under comprehensive plans.

- Vacation rental endorsements may not apply if you drive overseas.

Reading your declarations page line by line ensures you know exactly what’s protected—and what isn’t.

Common Mistakes Comparison

| Mistake | Potential Impact | Prevention Tip |

|---|---|---|

| State Minimum Liability Only | Out-of-pocket expenses > $20,000 | Increase limits to at least 100/300/100 |

| No UM/UIM Policy Stacking | Limited payout after underinsured crashes | Stack UM/UIM limits on all vehicles |

| Unreported Life Event | Denied claims or policy cancellation | Update your insurer within 30 days |

| Ignoring Exclusions | Surprise repair bills | Review policy exclusions annually |

By identifying these pitfalls early, you’ll strengthen your auto insurance basics and avoid the financial surprises that catch thousands of drivers off guard each year. You might also find How to Steer Clear of These 7 Common Pitfalls When Purchasing Car Insurance helpful.

Comments are closed.